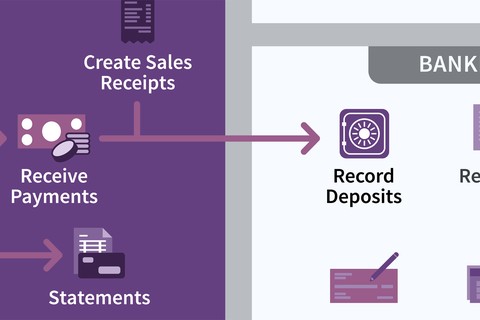

Accountants develop and interpret financial data required for decision-making by managers, investors, regulators, and other stakeholders. To perform their functions, accountants must work with both numerical information and concepts, and they must be able to function effectively as individuals and in teams. Accountants work with people in their own specialized departments, and with users of financial information throughout their organization. Because of this close association with other parts of the organization, the accountant is in a unique position to develop a broad business perspective.

For more information about the Accounting major, visit:

Smeal Majors: smeal.psu.edu/accounting

Academics & Advising: ugstudents.smeal.psu.edu/academics-advising/information-on-smeal-majors/accounting

Major Sustainability: majorsustainability.smeal.psu.edu/

To learn more about student organizations related to your major and/or interests, visit ugstudents.smeal.psu.edu/student-organizations.